flow through entity irs

A flow-through entity is a business entity is which income of the entity passes on to the investors or owners of the entity. The business income tax base refers to the flow-through entitys federal taxable income and any payments and items of income and expense that are attributable to the business activity of the.

How To File S Corp Taxes Maximize Deductions White Coat Investor

Flow-through entities can generally make the election for tax year 2021 by specifying a payment for the 2021 tax year that includes the combined amount of any unpaid quarterly estimated.

. Information about Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. A trust maintained primarily for the benefit of. The payees of payments other than income effectively connected with a US.

Its gains and losses are allocated or flow through to those. Trade or business and dispositions of interests in partnerships engaged in a trade or business within the United States made to a foreign flow-through entity are the owners or beneficiaries of. A flow-through is a business entity that may generate or receive taxable income but which pays no income tax in its own right.

In this legal entity income flows through to the owners. Flow-through entity income is reported by the entitys principals and tax paid on it regardless of whether any cash is distributed. Log on to Michigan Treasury Online MTO to update.

Passive Activity A trade or business in which. This disconnect between receipt of cash and. Rules for Flow-Through Entities.

The Form W-8IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. Participate Any rental without regard to whether or not the taxpayer materially participates A single entity. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest.

That is the income of the entity is treated as the income of the investors or owners. Branches for United States Tax Withholding and Reporting. You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following.

A flow-through entity is a business in which income is passed straight to its shareholders owners or investors. As a result only the individuals not the business are taxed. A flow-through entity is an entity through which income flows to the owners or investors without being subject to taxation at the entity level.

Flow-through entities FTEs affect an individuals Foreign Tax Credit FTC by impacting foreign source gross income foreign s ource taxable income worldwide gross income worldwide. Flow-Through Entity Tax - Ask A Question. Branches for United States Tax Withholding provided by a foreign.

A flow-through entity is a legal entity where income flows through to investors or owners. Flow Through Entity means an entity that for the applicable tax year is treated as a subchapter S corporation under section 1362a of the internal revenue code a general partnership a trust a. The most common type of flow-through entity is.

Through entity receiving a payment from the entity I certify that the entity has obtained or will obtain documentation sufficient to establish each such intermediary or flow-through entity. However the late filing of 2021 FTE returns will be accepted as timely if filed.

Irs Sweetens Tax Workaround For Nj Pass Through Owners Grassi Advisors Accountants

Complying With New Schedules K 2 And K 3

4 10 3 Examination Techniques Internal Revenue Service

3 13 2 Bmf Account Numbers Internal Revenue Service

:max_bytes(150000):strip_icc()/changing-your-llc-tax-status-to-a-corporation-or-s-corp-398989-FINAL-edit-a7c328f6cc494d9d9e60f964181583e4.jpg)

How To Change Your Llc Tax Status To A Corporation Or S Corporation

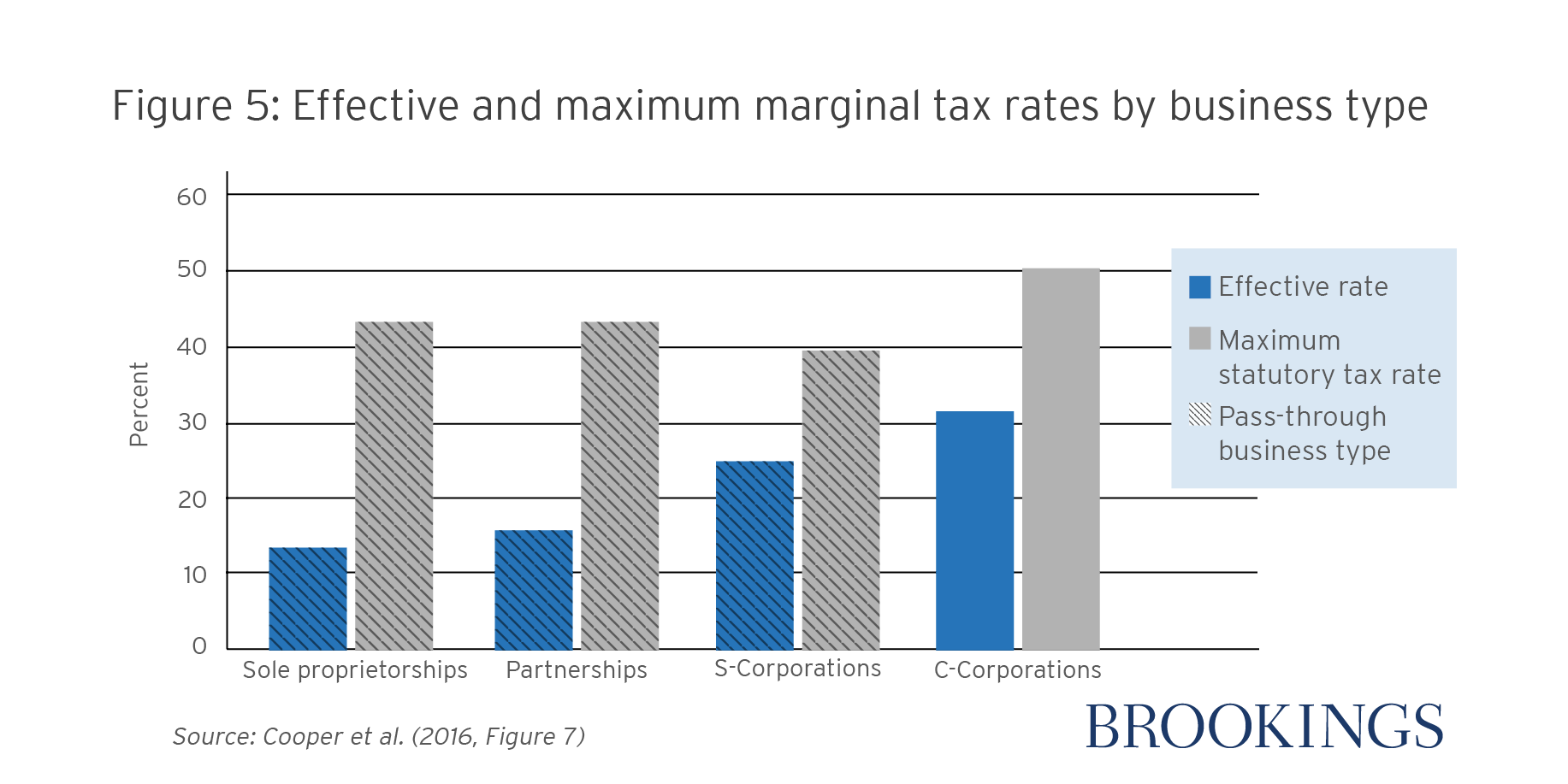

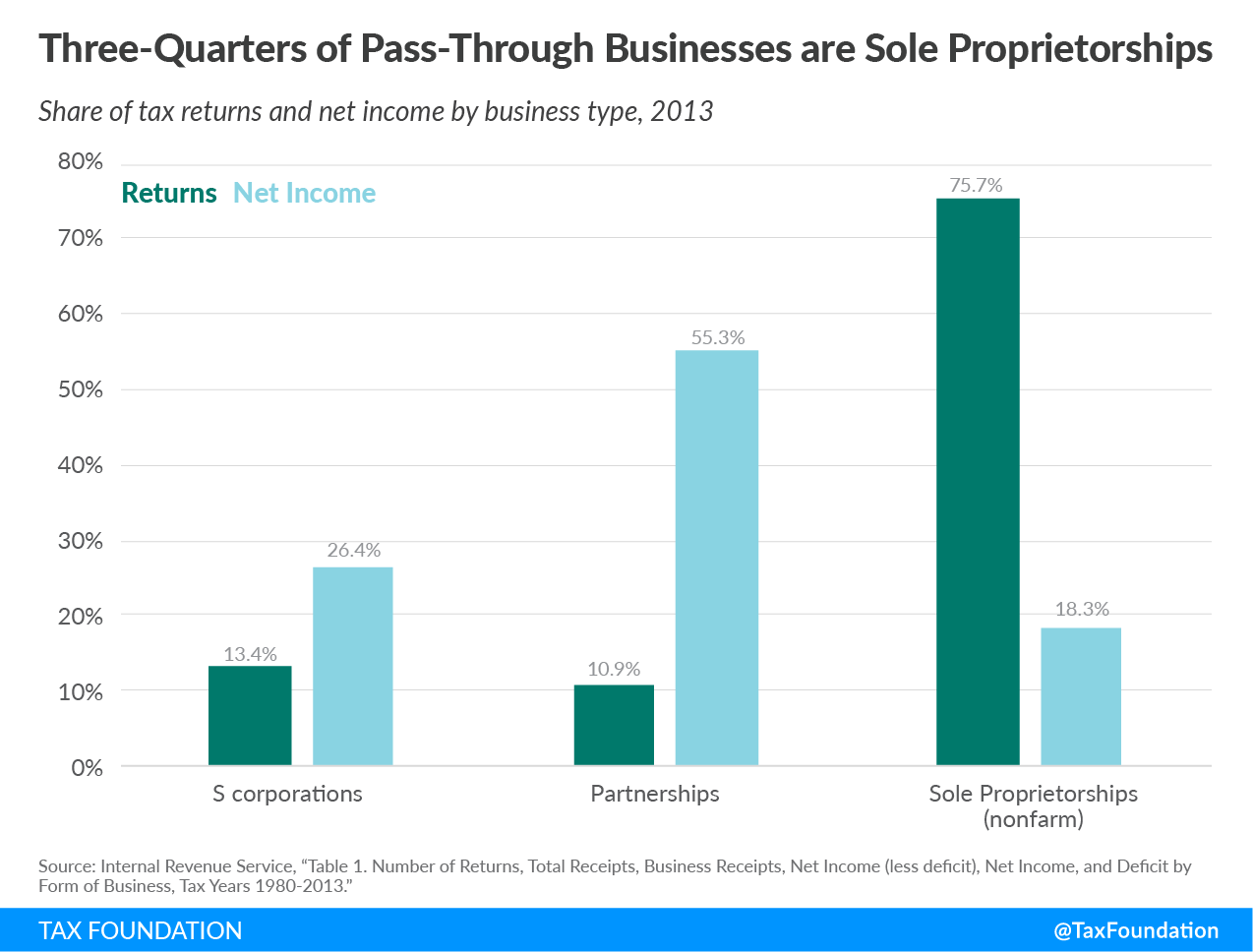

9 Facts About Pass Through Businesses

Large Partnerships Characteristics Of Population And Irs Audits Unt Digital Library

Pass Through Entity Salt Cap Workaround Lancaster Cpa Firm

Tax Reform S Implications Of The 20 Pass Through Entity Income Section 199a

Irs Issues Faq Guidance And Additional Relief For Pass Through Entity Returns

Louisiana Department Of Revenue Updates Partnership Reporting Requirements Cooking With Salt

What Is A Pass Through Business How Is It Taxed Tax Foundation

What Are Pass Through Businesses Tax Policy Center

:max_bytes(150000):strip_icc()/StateandLocalTaxCapWorkaround-1bbc2598e0144769b6e2542e11d22839.jpg)

State And Local Tax Cap Workaround Gets Green Light From Irs

What Does New York State S Pass Through Entity Tax Mean Foryou Rosenberg Chesnov

Irs Filing Requirements For Check Book Ira

Trends In New Business Entities 30 Years Of Data Legal Entity Management Articles

Do I Qualify For The Qualified Business Income Qbi Deduction Alloy Silverstein

4 Types Of Business Structures And Their Tax Implications Netsuite